Getting control of your finances may be a task you have been avoiding, but now is the time when you need to stop procrastinating. You have enough interest in the subject to click through to this article, so this must be something you need help with! Let’s get started:

Don’t be complacent

There are some costs that you think are always static – housing costs, utility bills, healthcare insurance, but it is most likely that you can find better deals. Businesses rely on customers to be complacent and not look for a more cost-effective solution.

So, research whether you can switch to cheaper providers. Can you get a more affordable TV package? Is your cell phone still a good deal? Save money by comparing deals when your contract comes up for renewal. Home warranties are a safety net for your home that are more cost-efficient than repeatedly paying out for big-ticket replacements. Always explore other options.

People get caught in the trap of living beyond their means. To reclaim control of your finances, you must understand how much money is coming into the household, and how much is going out. You can then make a realistic budget to live within. It’s hard work at the beginning, but you will be overjoyed when you finally have control of your finances.

Create a budget

How can you save money if you don’t where you are spending it or how much income you have? Creating a budget is the first step to gain control of your finances. It’s an itemized account of all money that hits your bank and leaves it.

For ease of use, an excel spreadsheet is the ideal way to create a budget so the figures can be calculated automatically – you don’t want errors in your budget.

Income

The household income is the amount of money that is available to spend each month. If you have a partner who contributes financially, include this figure too in the budget.

Outgoings

Using the last three months of bank statements, identify and list which category every payment out of your bank falls into. Here are some examples of category headings you can use:

- Living costs (groceries, clothes, toiletries, medication, etc.)

- Household costs (utilities, housing costs, telecoms, internet, etc.)

- Details of debts

- Insurance costs

- Travel expenses

- Leisure and entertainment costs

You have been asked to examine three months’ worth of outgoings to gain a more accurate picture of your spending – different months may have birthdays, anniversaries, or one-off big-ticket appliance repair payments, etc.When you are happy, the spreadsheet is accurate, divide the total amount for each category by 3. This will give you your average monthly spend for each heading.

Hopefully, your household income is higher than your outgoings. If it is not, you are going into debt each month, and you need to make some lifestyle changes. Now you can see where you need to save money, and you can set a realistic budget to live within.

How to make budget-friendly lifestyle changes

Most people equate saving money with feeling deprived. However, this simply is not true. Yes, you need to evaluate your spending habits, but that does not mean you have to stop living!

Savvy shopping

Savvy shopping is the most effective way to save money. Swap out branded groceries for cheaper versions; many times, you won’t even notice the difference. Use coupons to get discounts and join store loyalty schemes. Remember, you have a strict budget to stick to, so only buy items (even if they are discounted heavily) if you are going to use them!

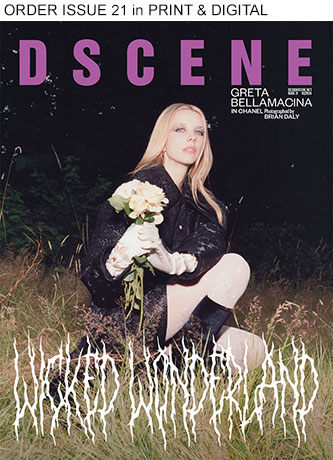

Images from Suburbia by Katy Pritchett for DESIGN SCENE Magazine Fall 2019 Issue – See the Full Story Here