Satin Tie Blouse SAINT LAURENT

Shorts VERSACE

Jewelry is often seen as a symbol of personal expression, status, and style. However, beyond the allure of shiny baubles and eye-catching designs, investing in quality jewelry can be a savvy financial move. In this guide, we’ll explore the history of jewelry as an investment, the factors that contribute to its value, and how you can capitalize on this unique and stylish asset.

Historical Context of Jewelry as an Investment

Jewelry as a Symbol of Wealth and Power

Throughout history, jewelry has been a marker of wealth, power, and social status. From ancient Egyptian pharaohs donning elaborate gold adornments to European royalty dripping in diamonds, valuable and well-crafted pieces have been a visible display of one’s success and influence.

Traditional Forms of Currency

Gold, silver, and gemstones have long been considered stable forms of currency. In times of economic uncertainty, these precious materials have retained their value and even appreciated. As a result, owning quality jewelry made from these materials can be a smart financial decision – especially if the pieces are well-crafted and timeless.

Economic Fluctuations and Value

The value of precious metals and stones can fluctuate depending on various economic factors. By investing in quality jewelry, you may be able to capitalize on these shifts, making it a potentially profitable venture. For example, if the price of gold rises (which it tends to do in times of economic instability), the value of gold jewelry pieces will also increase – thus giving you a potential return on your investment.

Jewelry as a Hedge Against Inflation

During periods of high inflation, the value of traditional investments like stocks and bonds may decline. However, quality jewelry made from precious metals and gemstones can act as a hedge against inflation, preserving its value over time. Right now, we are currently experiencing one of the highest levels of inflation in recent history – making jewelry a potentially valuable and sound investment.

Strapless Feather-Embellished Top MICHAEL LO SORDO

Waist Fitted Slit Pants A.W.A.K.E. MODE

Gilda Sandal AMINA MUADDI

Benefits of Investing in Quality Jewelry

Diversification of Investment Portfolio

Including quality jewelry in your investment portfolio can provide valuable diversification. As an alternative to traditional investments like stocks and bonds, jewelry can help balance risk and offer a tangible asset with intrinsic value. Just like with traditional art and antique investments, you can expect jewelry to hold its value over time – making it a great option for investors who are looking for long-term financial stability.

Insurable and Easy to Liquidate

Unlike cars, art, or real estate investments, jewelry is easy to store, insure, and liquidate. If the need arises, pieces can be sold quickly and converted into cash with relative ease. For those interested in expanding their investment in quality jewelry that artfully combines fashion with financial value, exploring reviews from Diamondere customers can offer insight into how real-life buyers perceive these high-end pieces. These reviews highlight overall satisfaction especially related to the timeless designs and lasting value of these gemstones set in crafted jewelry. Even a standard renters insurance policy can help reimburse you if your jewelry is lost or damaged, so you can rest assured that your investment is protected against unexpected events.

Wearable Investment

One of the most appealing aspects of investing in jewelry is its wearability. Unlike other investments, quality jewelry can be enjoyed and shown off while still maintaining its financial potential. Rather than having your investment sitting in a bank account, you can wear your jewelry and appreciate its beauty.

Sentimental Value

Quality jewelry can also hold sentimental value, allowing it to serve as a cherished heirloom that can be passed down through generations while still maintaining its financial worth. This is a trait unique to jewelry that makes it a particularly valuable investment – one that can be enjoyed and appreciated aesthetically, emotionally, and economically.

Understanding the Value of Quality Jewelry

To determine the value of a piece of jewelry, one must consider factors such as:

- Materials used

- Craftsmanship quality

- Age

- Historical relevance

- Previous ownership

Quality jewelry often holds its value well and can even appreciate over time. The intrinsic value of the materials, collector’s interest, and market demand all play a role in determining their worth – so keep these factors in mind when considering investing in jewelry (or when liquidating your assets).

Furthermore, investing in certified and authentic pieces of jewelry is crucial to ensure their value. Certification from reputable organizations, like the Gemological Institute of America (GIA), can provide confidence in your investment.

Straight Leg Pants GIVENCHY

Gilda Sandal AMINA MUADDI

Selecting the Right Jewelry Pieces for Investment

Researching Reputable Brands and Designers

To make a wise investment in quality jewelry, it’s essential to research reputable brands and designers known for their craftsmanship and timeless designs. By choosing well-established names, you increase the likelihood of your investment retaining or appreciating in value.

Identifying Timeless and Classic Designs

Investing in classic, timeless pieces increases the likelihood of their retaining and appreciating in value. These styles are more likely to maintain their appeal and demand over time, ensuring that your investment remains attractive to potential buyers.

Focusing on High Intrinsic Value Materials

Materials such as gold, platinum, and diamonds have high intrinsic value, making them ideal for investment purposes. When selecting jewelry for investment, prioritize these materials to maximize potential returns.

Proper Care and Maintenance

To preserve the value of your investment, it’s crucial to care for and maintain your jewelry. This includes proper storage, cleaning, and professional servicing when necessary. Maintaining your pieces in pristine condition can help you command a higher resale price.

The Art of Selling and Trading Quality Jewelry

Selling Jewelry at the Right Time

Monitoring market trends and timing your sale during periods of high demand can help you maximize your returns. Stay informed about the current market conditions and be prepared to act when the time is right.

Utilizing Expert Appraisers and Auction Houses

When selling or trading quality jewelry, it’s essential to work with expert appraisers and reputable auction houses. These professionals can help you accurately assess your piece’s value and connect you with potential buyers or traders.

Trading and Bartering Jewelry for Other Valuable Assets

Quality jewelry can be used as a tool for trading or bartering for other valuable assets. This can open up unique opportunities for growing your investment portfolio or acquiring rare and sought-after items.

Tax Considerations and Legal Aspects

When buying, selling, or trading quality jewelry, it’s important to be aware of the tax implications and legal aspects. Any profits generated from selling jewelry will likely qualify as a capital gain, in which case a tax calculator may be necessary to help ensure accurate calculations. Understanding the relevant laws and regulations can help you make informed decisions and avoid potential pitfalls.

Strapless Feather-Embellished Top MICHAEL LO SORDO

Final Word

As a wearable, tangible, and enjoyable investment, quality jewelry offers a unique opportunity for financial growth and diversification. By selecting the right pieces, properly maintaining them, and navigating the world of selling and trading, you can transform your passion for fashion into a smart financial move. Embrace the world of jewelry investing and discover the potential it holds for both your wardrobe and your wallet.

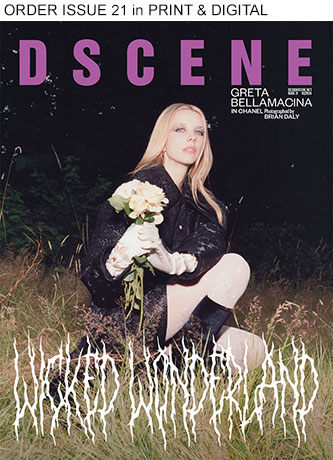

Images from DSCENE STYLE STORIES: Glares by Julia Sariy – See the full story here