While some people may find it absurd to buy a home in their twenties, it is a profitable idea that has several financial benefits to the investor. Below are 5 major financial benefits of buying your home in your twenties.

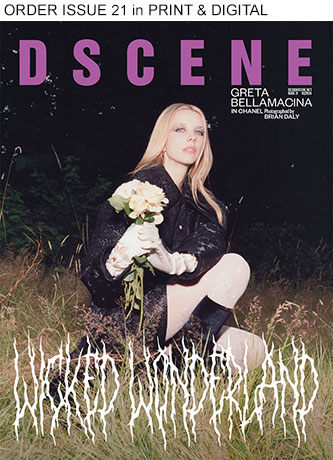

Read more tips from DSCENE editors after the jump:

You Invest in Your Future

Investing in your future is something that should begin early. In your twenties, you do not have so many responsibilities to handle as such it is the best time to buy a house. Doing so this early will help you clear your online mortgage bills early enough, giving you an opportunity to focus on other things once you are older. Another benefit of buying your home in your 20’s is giving you ample time to pay off your mortgage so that you can use the equity during retirement years through a reverse mortgage loan.

You Build Your Credit

Investing in a house is one of the significant ways an individual can build their credit. In case you have other projects that need financing in the future, your banking partner will not hesitate to give you a loan to finance the projects. “This is because they believe you are responsible enough to handle more money considering that you have managed to buy a house that early, especially if you have a positive payment history,” says mortgage broker Habito.

If you are from California, you can go for hard money loans California for short term financing for your needs of any type. If you are eligible for bridge loans, you can go for bridge loan financing as well. But make sure you use these options for short term financing only.

You Learn Better Spending Habits

There is no better way to teach yourself how to spend your money responsibly than through buying a house. You cultivate a sense of independence that allows you to make decisions wisely. Knowing that there is a mortgage bill due at the end of the month will give you the motivation to reduce the amount of money you spend on luxury items, to allocate funds for it.

You Experience Tax Benefits

These benefits are only available to individuals who itemize their property. While the amount on itemized homes has reduced significantly by $125,000, you still get to bag $375,000 individually or $750,000 when you file jointly with your partner. Also, when soliciting for funds to finance your mortgage, you may have paid points to your financier. Points are calculated in percentage form with each point holding a 1% value. You are entitled to a refund for each point you paid for. So You get a refund based on the number of points you paid for and the value of your home. So if your house costs $1,000,000 and you bought one point, a refund of $100,000 is accredited to you by the lender.

You can also reap big from your state when you opt to make renovations to factor energy conserving options like solar panels. You may qualify for up to 30% federal tax credit on the installation. If this is not your plan, however, you can find other options that save energy like using LED lights in your garage.

Images – Halo. Architecture’s Simple but Impressive Apartment in Poland